The Buzz on Hard Money Atlanta

Wiki Article

Rumored Buzz on Hard Money Atlanta

Table of Contents7 Simple Techniques For Hard Money Atlanta3 Simple Techniques For Hard Money Atlanta10 Easy Facts About Hard Money Atlanta Explained5 Simple Techniques For Hard Money Atlanta

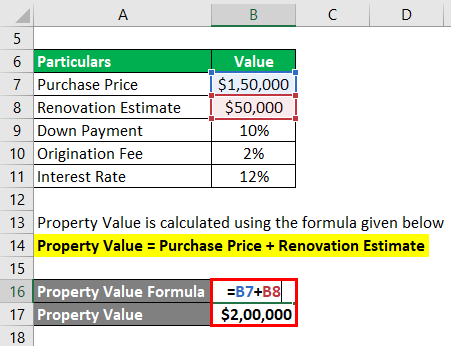

By comparison, interest prices on hard money fundings start at 6. Tough cash loan providers typically charge points on your financing, occasionally referred to as origination charges.

Factors are usually 2% to 3% of the loan quantity. 3 factors on a $200,000 funding would certainly be 3%, or $6,000. You might need to pay even more factors if your funding has a higher LTV or if there are several brokers associated with the transaction. Some lending institutions charge only factors and no other charges, others have added costs such as underwriting fees.

The Facts About Hard Money Atlanta Revealed

You can anticipate to pay anywhere from $500 to $2,500 in underwriting fees. Some hard cash loan providers likewise charge early repayment charges, as they make their money off the interest costs you pay them. That suggests if you settle the car loan early, you might have to pay an extra cost, including to the funding's price.This implies you're more probable to be supplied funding than if you looked for a typical home mortgage with a questionable or slim credit background. hard money atlanta. If you need money swiftly for remodellings to turn a house commercial, a tough money car loan can provide you the cash you need without the trouble and also paperwork of a typical mortgage.

It's a strategy capitalists use to get investments such as rental residential properties without making use of a great deal of their own properties, and also difficult money can be useful in these situations. Although tough money financings can be beneficial for genuine estate capitalists, they must be utilized with caution particularly if you're a newbie to realty investing.

With much shorter payment terms, your month-to-month settlements will certainly be much more expensive than with a normal home mortgage. If you fail on your car loan payments with a tough cash lender, the consequences can be extreme. Some financings are personally assured so it can harm your debt. And also due to the fact that the financing is safeguarded by the residential or commercial property in concern, the loan provider can occupy and confiscate on the building because it works as collateral.

3 Simple Techniques For Hard Money Atlanta

To discover a reliable lender, talk to relied on property representatives or home loan brokers. They may have the ability to refer you to loan providers they've functioned with in the past. Difficult cash lenders additionally commonly attend real estate investor conferences to make sure that can be a good place to get in touch with lending institutions near you. hard money atlanta.Equity is the value of the home minus what you still owe on the home mortgage. The underwriting for home equity finances additionally takes your credit background and income into account so they have a tendency to have lower passion rates and longer settlement durations.

When it comes to moneying their following deal, genuine estate financiers as well as business owners are privy to several offering alternatives basically made for property. Each comes with specific requirements to accessibility, and if utilized correctly, can be of substantial advantage to investors. One of these loaning kinds is tough money borrowing. hard money atlanta.

It can also be termed an asset-based funding or a STABBL financing (short-term asset-backed bridge car loan) or a bridge loan. These are acquired from its particular temporary nature and the requirement for concrete, physical security, usually in the form of actual estate property.

More Help

The Only Guide for Hard Money Atlanta

They are concerned as temporary swing loan as well as the significant use instance for hard cash lendings is in property deals. They are thought about a "hard" money car loan as a result of the physical property the real estate building needed to protect the financing. In the occasion that a customer defaults on the funding, the loan provider reserves the right to assume possession of the residential or commercial property in order to recover the financing amount.In the very same blood vessel, the non-conforming nature pays for the lenders a possibility to choose their own details demands. Therefore, needs may vary considerably from lender to loan provider. If you are looking for a finance for the very first time, the authorization process might be reasonably rigid and also you might be required to provide extra details.

This is why they are generally accessed by realty business owners that would typically need rapid financing in order to not lose out on hot possibilities. Additionally, the loan provider mostly thinks about the worth of the possession or home to be purchased rather than the customer's individual financing background such as credit Website rating or revenue.

A conventional or small business loan might use up to 45 days to shut while a hard money loan can be shut in 7 to 10 days, check that sometimes quicker. The convenience and also speed that tough money lendings use remain a significant driving force for why investor select to utilize them.

Report this wiki page